The $10.5B Trigger That Could Rewrite COMM’s Entire Story

Why the debt unwind creates a real opportunity for traders who know what to look for.

Most traders only see a stock that ran more than 200 percent this year. They do not see the underlying shift that created the move.

Here is the real story.

The Setup: Why This Trade Even Exists

COMM spent years held down by one thing: leverage. The CCS sale to Amphenol is the first event in a long time that finally breaks that ceiling.

The Real Story Behind That 200 Percent Move

The market did not wake up one morning and decide to rerate CommScope.

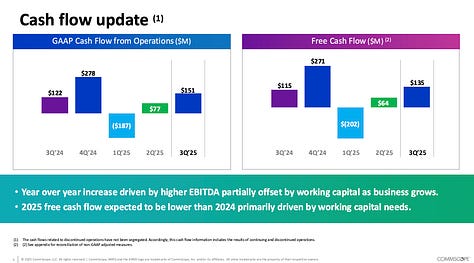

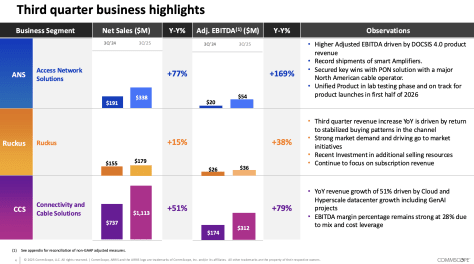

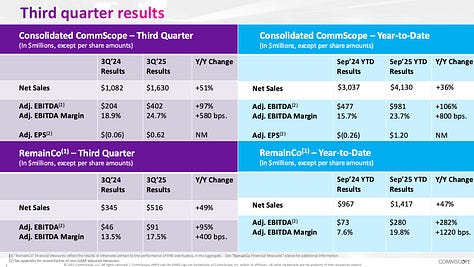

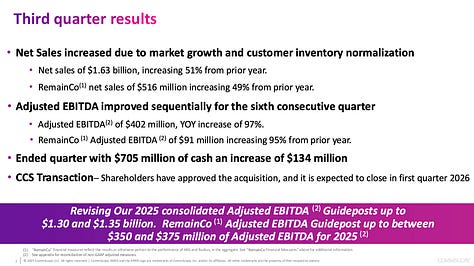

The rerate started when the company delivered consecutive beats, expanded margins, and showed that cost discipline was real.

Once the CCS sale was announced, the market recognized something simple. The debt problem had an end date.

The Catalyst That Changes Everything

The entire thesis rests on a single transaction.

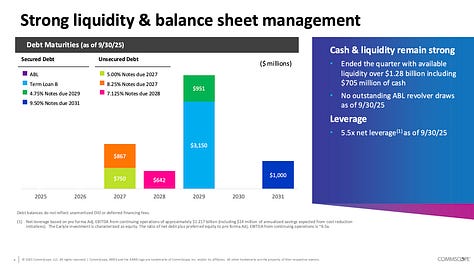

Amphenol is paying $10.5 billion cash to acquire the CCS segment. Once that closes, CommScope eliminates most of its debt, reduces interest load, and removes the balance sheet drag that kept institutions out.

That is the hinge. Without the deal, COMM is just another stressed balance sheet.

With the deal, it becomes a focused operator with a clean financial runway.

Keep reading with a 7-day free trial

Subscribe to The Edge Lab to keep reading this post and get 7 days of free access to the full post archives.