Most traders spend their entire careers obsessing over entries.

Few spend the same energy on exits.

That’s a costly mistake.

Because without a framework for taking profits, you’ll:

Sell too early and leave money on the table

Hold too long and watch profits evaporate

Or worse, turn winning trades into losing ones

This is where Fibonacci Extensions come in.

Time Stamps

00:00 Introduction to Fibonacci Extensions

02:09 How to Draw Extensions

05:04 Identifying Extension Levels

07:13 Further Analysis on Rocket Lab

09:21 Example: Uber Analysis

11:38 Key Extension Levels Overview

13:49 Why Extensions Work

15:36 Combining Extensions with Structure

24:27 Shorting with Extensions

30:29 Recap of Fibonacci Extensions

What Are Extensions?

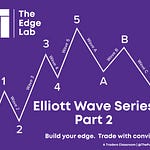

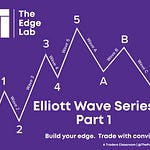

If retracements tell us where price may pull back, extensions project where price is likely headed next.

They’re the roadmap beyond prior highs and lows… profit zones that traders, institutions, and algorithms alike respect.

The most common and powerful extension levels:

127.2% → Shallow, often hit quickly

161.8% → The “golden extension,” high-probability target

200% & 261.8% → Stretch zones, common in strong or parabolic moves

How to Draw Them

Listen to this episode with a 7-day free trial

Subscribe to The Edge Lab to listen to this post and get 7 days of free access to the full post archives.