A Bounce Arrives, but the Path Forward Is Not Straight

Good morning everyone.

We finally got a bounce today, and while it is a welcome shift in tone, it does not confirm a bottom. It is a reaction inside a larger unwind, and the structure across SPY and QQQ still reflects pressure.

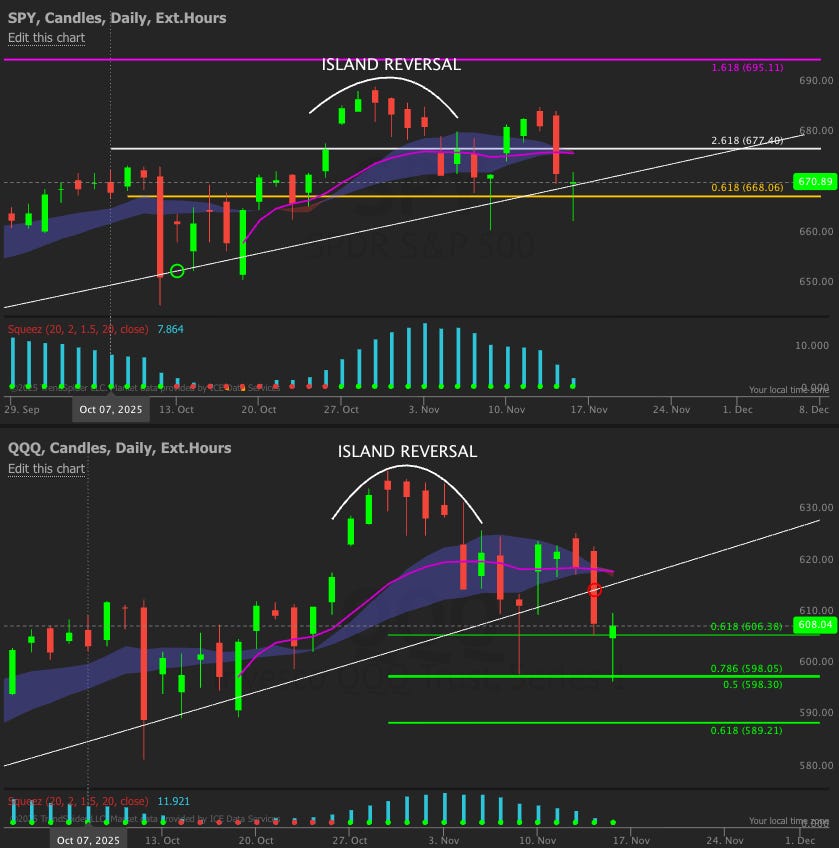

Last week gave us island reversal patterns on $SPY & $QQQ, breakdowns, and flushes into major levels. Today’s bounce was expected, but not enough to relax. The work is still ahead.

Below is where we stand right now and what matters going into next week.

Where the Market Stands After This Morning’s Flush

Almost every name on the screen bounced hard after the gap down. This is a constructive sign. Many bottoms start with a sharp morning flush that wipes out the remaining sellers. It is possible that this morning’s gap down was that final shakeout. The key question heading into next week is simple. Do the lows from this morning hold?

For now, the action looks healthier, but the environment is still the focus. I am not trying to catch the exact bottom. I want to see the environment improve. Less volatility, fewer overnight gaps, and fewer negative reactions to good news. Those are the signals that matter.

Until then, patience is the edge.

Here is the bigger picture beneath today’s bounce:

• VIX still has room before signaling a true washout

• Retail positioning remains trapped

• Put/Call ratios have not shown panic

• Gamma exposure still amplifies down moves

• Breadth is improving intraday but still weak on weekly charts

This bounce is a step in the right direction, not the finish line.

SPY: Support Hit, Bounce Registered

SPY bounced right where it needed to. The reaction near the 0.618 Fib projection level held and price reclaimed short term support. Buyers stepped in with force, but overhead resistance remains.

The key things I am watching:

• Reclaiming the breakdown zone

• Holding above the rising trend line

• Behavior near the island reversal neckline

A constructive path would be a slow climb into resistance. A failed attempt opens the door for a retest of this morning’s lows.

QQQ: Same Structure, Same Story

QQQ hit a cluster of Fibonacci levels, flushed, and bounced. The zone between 606 and 610 is the first real test on the upside. If price fails there, 598 and 589 remain the next magnet levels.

This morning’s low is now the line in the sand. If it holds, confidence builds. If it breaks, the correction continues.

The Catalyst That Will Define Next Week

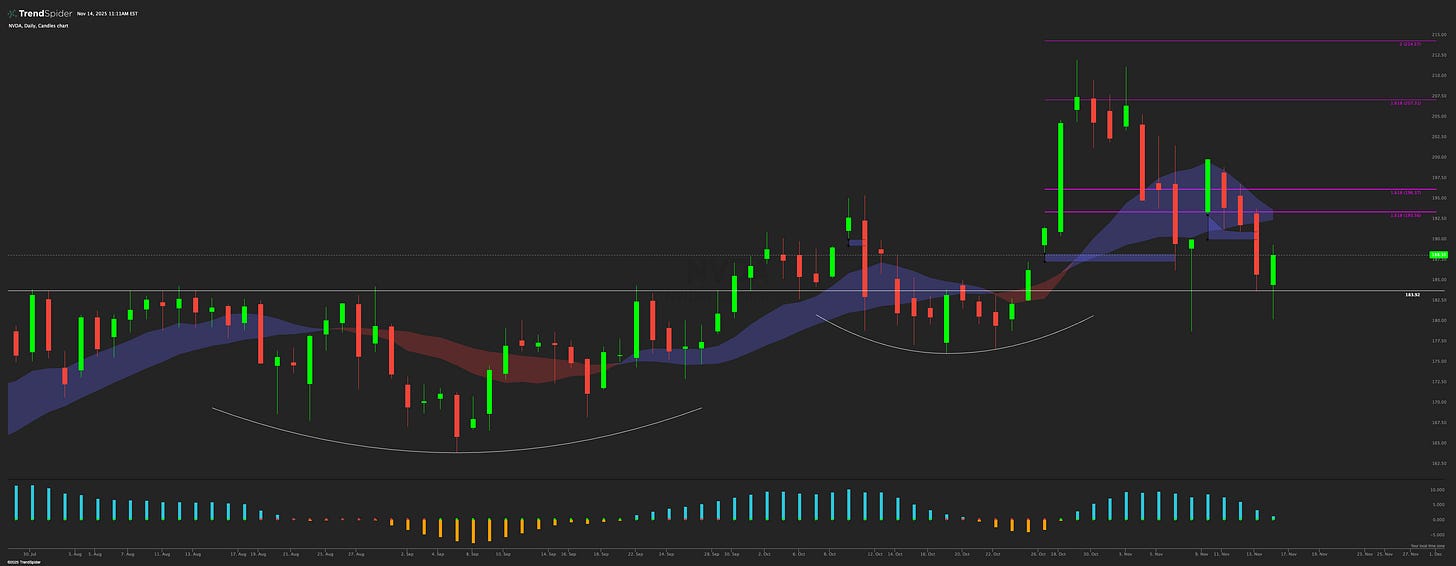

NVDA earnings on Wednesday 11/19 after the close

This is the event the market is building toward. NVDA has carried the emotional weight of this cycle. AI sentiment, growth expectations, and even macro narratives are tied to it.

A strong report could stabilize risk appetite and improve the environment. A weak report could accelerate the downside and pressure SPY and QQQ into lower supports.

This is the central domino for the week.

What Next Week Could Look Like

1. Gradual stabilization into NVDA

We grind higher, volatility cools, and resistance levels get tested. This is the healthiest path.

2. Retest of this morning’s lows

Many bottoms retest before turning. A successful retest would strengthen the base.

3. Failed bounce and lower lows

Rejections at overhead levels combined with a weak NVDA print could lead to deeper weekly chart targets.

4. Momentum reset if NVDA delivers

A strong quarter could energize semis, improve sentiment, and bring leadership back.

How I Am Trading This Tape

My focus is simple. Let the environment improve before taking risk.

I want:

• Less volatility

• Fewer overnight gaps

• Better reactions to news

• Stronger breadth

• Clearer pivots forming in the highest quality names

Cash remains a strong position until the tape rewards aggression. The goal is not to nail the exact bottom. The goal is to enter when the environment supports consistency.

This morning’s flush and bounce is a step. Now we see if the market can build on it next week.

I will post updated SPY and QQQ charts so you can follow the exact levels I am watching inside of my notes, along with all the relative stregnth names on my watchlist.

Stay patient. Stay focused. Let the leaders announce themselves.

Have a great weekend!

-Pup

Disclaimer:

This content is for educational and informational purposes only. It is not financial advice or a recommendation to buy or sell any security. All trading involves risk. Always do your own research and consult with a licensed financial advisor before making investment decisions. I may hold positions in the securities mentioned.